HOUSE PRICES SHOW RECORD GAINS, CONTINUED RISING VALUES EXPECTED

HOUSE PRICES RECORD GAINS; EXPECTED TO RISE By Michael Neal

The recent release by the Federal Housing Finance Agency (FHFA) shows that its measure of house prices, House Price Index – Purchase Only, rose by 5.1% on a 12-month seasonally adjusted basis in January 2015. This marks the 36th consecutive month of year-over-year growth. Over this nearly three-year period, house prices have risen by 20.1%.

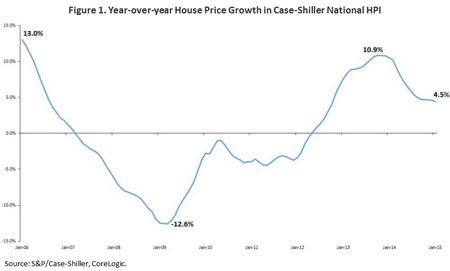

Similarly, the recent release from Standard and Poor’s (S&P) and Case-Shiller indicates that their measure of national house prices, the House Price Index – National, rose by 4.5% on a year-over-year seasonally adjusted basis. This is the 33rd consecutive month of year-over-year increases in the house price index. Over this period of more than two-and-a-half years, house prices have risen by 22.1%.

According to the S&P/Case-Shiller – National House Price Index, year-over-year house price growth was slowing in recent months. In each month between December 2011 and October 2013, the 12-month change in house prices was higher than the previous month. Year-over-year house price growth peaked at 10.9% in October 2013. However, as Figure 1 below illustrates, annual house price growth was 4.5% in January 2015.

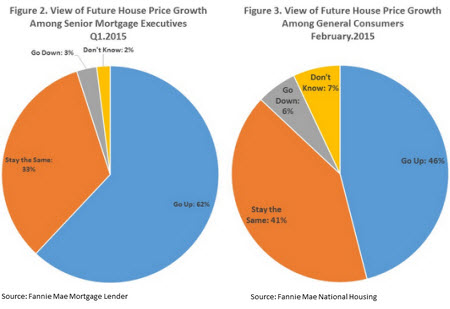

House prices are expected to continue to grow and few expect house prices to go down. According to separate data from Fannie Mae, although most expect house prices to continue to go up, senior mortgage executives are more optimistic about house price growth than the average consumer. The difference in the level of optimism about future house price growth largely reflects consumers' view that house prices will likely stay the same over the year.

As Figure 2 below illustrates, 62% of senior mortgage executives, when polled by Fannie Mae's Mortgage Lender Sentiment Survey, expect house prices to rise over the next 12 months. Meanwhile, one-third of senior mortgage executives expect house prices to stay the same while only 3% expect house prices to fall over the year. According to the National Housing Survey, a representative survey of the general population that is also administered by Fannie Mae, the greatest proportion of consumers, 46%, believe that house prices will rise over the year, but 41% believe that house prices will remain the same, 8 percentage points higher than the share of senior mortgage executives that express the same view. Meanwhile, only 6% of consumers believe that house prices will fall.

We at BootheGlobalPerspectives saw the same trends, with fairly rapid growth in 2014, then in January of 2015, with the rapid drop in oil prices, the market seemed to pause and take a breath. But our appraisal company, Boothe Appraisals has seen a definite increase in real estate values and activity in March, April and May. It is again time to buy houses, and oddly, the one of the leading groups of house activity and value increase is homes that are 3,500 s.f. to 5,500 s.f. in size. Normally the smaller homes increase in value the most, but we are seeing pent up demand for upper middle class, and luxury sized homes.